In this comprehensive resource, we’ll provide you with a thorough overview of Florida’s Car Accident laws from start to finish.

Simply complete the form to receive a downloadable PDF version of the guide for future reference.

Car accident injuries impact over two million Americans every year. Most must visit the emergency room and require longer-term medical care. Some find themselves temporarily or permanently disabled. The accident victims who sustain serious injuries also experience pain and suffering, emotional distress, and loss of quality of life.

Florida is one of the few no-fault car insurance states. According to this policy, your car insurer must pay your economic damages regardless of fault. For instance, even if you caused an accident that totaled your vehicle, cost you thousands in medical bills, and prevented you from working for a long time, your insurer must compensate you for those damages.

But Florida’s no-fault car insurance rule does not pertain to general damages. General damages include the non-economic impacts of the accident, including pain and suffering, emotional distress, and loss of quality of life.

When another driver is at-fault, you are entitled to damages, but you must seek them from the other party’s insurer. This usually involves filing a lawsuit. Even if you have partial responsibility for the accident, you may be entitled to a general damages settlement.

After a crash, the first priority should always be to report the accident to the police. This action summons needed emergency personnel to care for the injured. Also, Florida law requires you to report all vehicle accident injuries.

From a legal perspective, taking additional steps to protect your rights makes sense.

Immediately following the accident, do whatever is needed to protect your safety and the safety of others, such as the following:

If you are involved in an accident caused by another party, you want to gather and preserve any evidence of how the accident happened. Proof of the other party’s liability can make the difference between collecting your total general damages and receiving nothing.

Steps you can take to gather and preserve evidence include the following:

Seeking medical care is vital for the health of your body and your legal case.

Car accidents cause various types of injuries, even at slower speeds. The full extent of the physical damage from a collision may be unapparent until hours, days, or weeks have passed. If you wait to seek medical treatment, the defense can exploit this gap to raise doubt about whether the accident caused the injury. By receiving a comprehensive medical exam right away, you ensure both the best chance of a full recovery and a solid legal claim.

Regardless of fault, the law requires you to inform your insurance company. This is also clearly financially advantageous because your insurer must cover all of your economic damages. Further, your insurer can subrogate against the other company for your general damages.

Here are some additional reasons to report a car accident ASAP:

Personal injury lawyers specialize in car accident claims. Many offer free consultations where they evaluate your claim and determine if you have a case for general damages. If so, they negotiate with the insurance company and take the case to court when necessary.

The last thing you want is to be shorted compensation. Medical bills, lost income, and other expenses can leave you indebted. You may suffer substantial pain, which is also compensable. A personal injury attorney sees that you receive the benefits you deserve.

A car accident can leave you injured, financially strapped, and trapped by a reduced quality of life. No one wants to contemplate physical pain and the isolation and misery that goes with long-term hospital stays, surgeries, and lengthy convalescence.

When you have suffered a serious injury in a Florida car accident, you deserve full compensation for all of your losses, financial and non-monetary.

Failing to file a timely personal injury claim can cause you to lose substantial compensation. Once the statute of limitations passes, you lose your right to seek compensation through the legal system forever.

As of 2023, Florida law establishes a four-year statute of limitations for car accident lawsuits. This means that the plaintiff must file within four years of the accident. Courts dismiss claims filed after this deadline without regard to their merits.

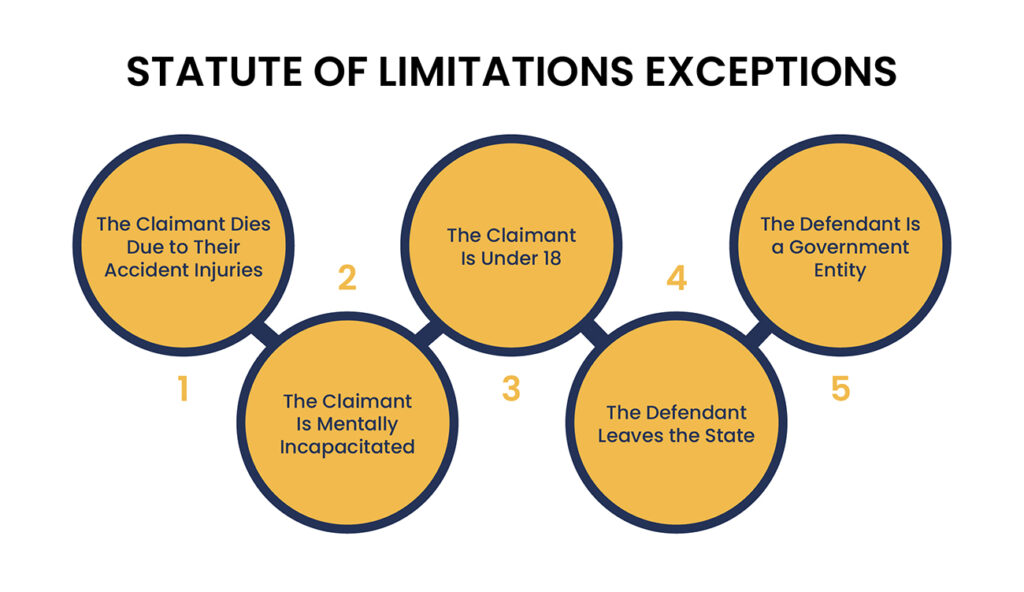

However, exceptions exist that alter the statute of limitation in many situations.

Florida is a no-fault car insurance state. According to this policy, your insurer must pay all of your economic damages regardless of fault. These include property damage, medical expenses, and lost income.

But the victims of serious accidents suffer non-monetary damages as well. These include pain and suffering, emotional distress, and loss of quality of life. Florida law allows car accident victims to seek these damages through the courts, provided the injury was severe. For example, the loss of body function, disability, and disfigurement qualify injuries as severe.

To win a car accident personal injury lawsuit in Florida, the plaintiff must prove that the other party was mostly at fault. If the plaintiff bears partial fault, he can still collect but at a lower percentage of his damages.

Therefore, it’s always prudent to begin building a case as soon as possible after a car accident. Gathering and preserving evidence of the other party’s negligence is key to winning the claim. Even if you believe you will have only economic damages, gather any evidence in case you need it later. For example, your injury may become more serious than initially thought and cause disability.

Consulting a personal injury lawyer is always advisable. The attorney can determine the strength of your legal claim and ensure you meet all requirements for the case to succeed, including meeting the statute of limitations.

Many exceptions to the statute of limitations exist. Some create a shorter filing deadline, while others stop the clock while certain conditions persist, giving the plaintiff additional time.

The four-year statute of limitations applies to personal injury lawsuits. However, many car accident claims are filed under wrongful death because the collision killed the victim. The wrongful death statute of limitations is two years from the victim’s death.

Accordingly, if the victim died on the day of the incident, the family has two years to bring a claim. If he dies in the hospital weeks later, the family has two years from that date.

Florida law tolls the statute of limitations when the victim suffers temporary mental incapacity, extending the time the plaintiff has to file. For instance, imagine a car accident victim is in intensive care and then rehab for six months after the accident and unable to make legal decisions due to his condition. This results in the statute of limitations pausing until the victim regains his faculties.

A legal guardian may file a lawsuit while the plaintiff is incapacitated.

Minors are legally prohibited from making legal decisions on their behalf. As a result, the statute of limitations begins to run on their 18th birthday, extending the period they can file. However, Florida law limits the total time to file a lawsuit for minors to seven years from the accident, impacting accident victims under 15.

A parent or guardian may file a lawsuit on behalf of a minor.

To file a car accident case in Florida, the plaintiff must serve the suit on the defendant within the state. As a result, if the defendant leaves Florida before receiving the lawsuit, the statute of limitations pauses until the defendant returns.

Government entities include state, country, and municipal agencies. Filing a car accident lawsuit against them requires a separate process. Firstly, you must file a claim directly with the agency within six months of the accident. Failure to do so eliminates your right to seek damages. You can file a lawsuit only after exhausting the claims process with the agency.

Florida’s statute of limitations on car accidents is generous compared to many other states with two-year deadlines. However, waiting to file a lawsuit is ill-advised. Evidence may disappear, or the defendant may leave the state, making it more difficult to recover damages. The sooner you start the process, the better your odds of success.

As a no-fault car insurance state, Florida requires each policyholder’s insurer to pay their economic damages regardless of fault. Economic damages include property losses, medical expenses, and lost income. As a result, Floridians often collect their full damages without bringing a lawsuit against the at-fault party.

However, the no-fault car insurance rule provides no provision for general damages. General damages are the non-monetary impacts of a personal injury, such as pain and suffering, emotional distress, and loss of enjoyment of life. If another person’s negligence caused you these damages, you could collect from the other party’s auto insurance, though reaching a fair settlement may entail a lawsuit.

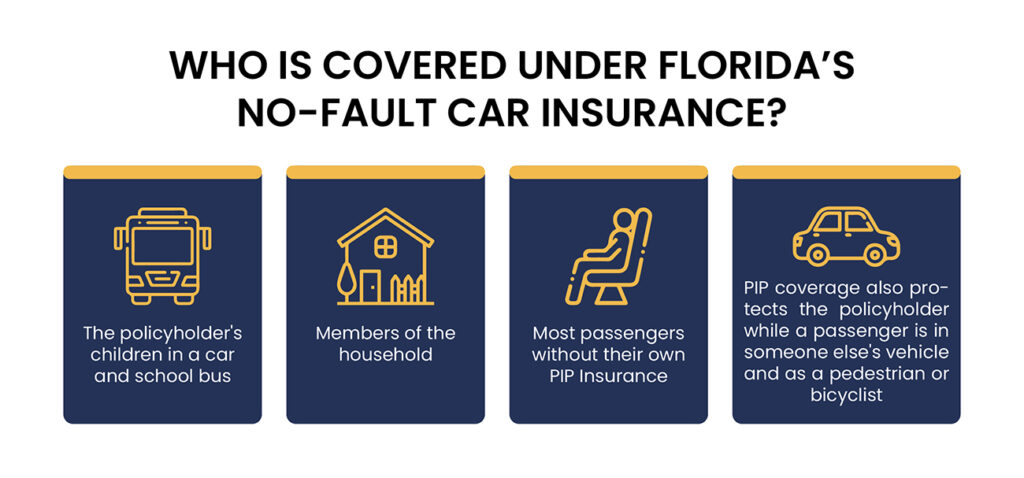

The personal injury protection (PIP) benefits of a Florida car insurance policy are its no-fault component. PIP is the coverage that takes effect regardless of who is at fault for the car accident. PIP protections cover the policyholder plus the following individuals:

Under Florida law, a PIP claimant can receive the following:

For PIP coverage to be effective, the claimant must undergo medical diagnosis and treatment within 14 days.

For example, you cover this requirement if you go to the emergency room immediately after the accident. However, if you opt against going to the emergency room, you need to see a doctor about any injury from the accident within 14 days.

To pursue a liability claim against the at-fault driver, your car accident injuries must qualify as serious as defined by state law. as that term is defined by state law. Florida law defines a serious car accident injury as one of the following:

If your injuries meet this definition, you have a personal injury case against the at-fault party. Pursuing the personal injury claim starts with filing a third-party car insurance claim against the other motorist’s insurance policy. Then, that company’s claims adjuster investigates the incident and renders a decision.

Your Florida personal injury lawyer can negotiate with the insurance company if you disagree with this decision. If those negotiations fail to result in an equitable settlement, you must file a lawsuit against the insurer.

To register and drive a motor vehicle in Florida, vehicle owners must have the following:

Florida law does not mandate drivers to carry liability coverage for bodily injury suffered by other drivers, passengers, pedestrians, and bicyclists. However, opting for bodily injury liability coverage is a wise financial decision.

Should you be at fault for a car accident, the victim(s) may suffer a substantial injury that qualifies them to file a personal injury lawsuit. In that case, you need bodily injury liability coverage to avoid having to defend a personal injury lawsuit and pay a settlement or award out of pocket.

Severe car accident injuries in Florida have resulted in liability determinations in the tens of thousands, hundreds of thousands, and millions of dollars. Few individuals have the financial wherewithal to fund such a settlement without the danger of losing everything they have and still being in debt.

Once a civil judgment has been entered against you, the other side can petition the court to take assets to satisfy the claim. Also, they can apply for garnishment of wages and other income. These actions spell financial disaster for the liable party.

No-fault car insurance in Florida makes the claims process more accessible in many cases. However, at-fault drivers still have liability for general damages, such as pain and suffering.

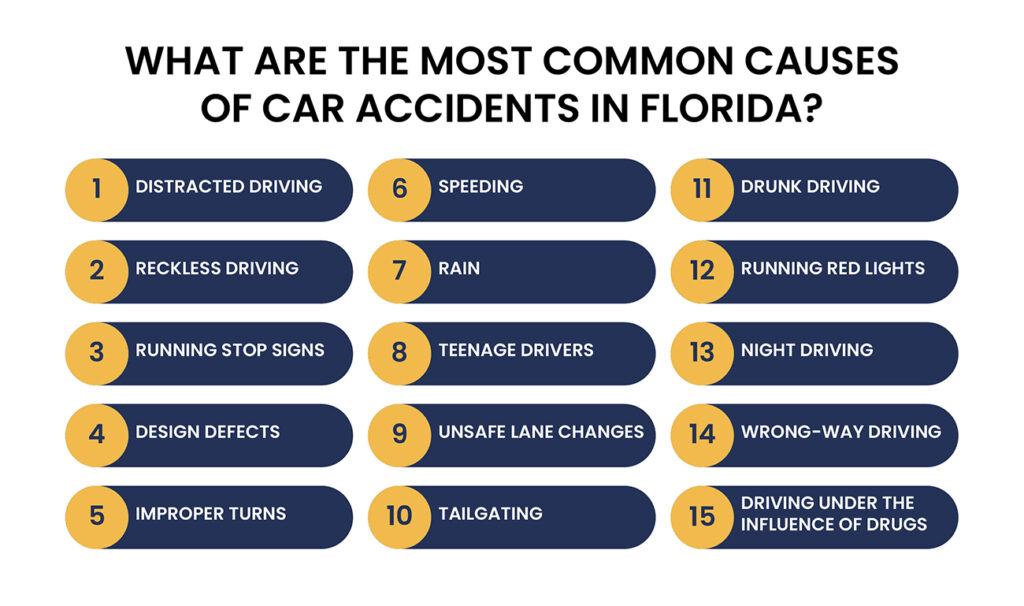

Car accidents happen for myriad reasons, but some causes are the most prevalent. Here are the 15 top causes of auto accidents in Florida:

Unsurprisingly, distracted driving tops the list. We’ve all seen them on the road texting, talking on the phone, eating, or otherwise dividing their attention between the road and something else. When this division of attention causes them to crash, other people suffer.

In many parts of Florida, speeding is an epidemic. Legions of drivers ignore the speed limit entirely, driving 10-, 20- and 30-plus mph over the limit. Higher speeds make accidents far more likely and increase their severity. Speed kills. It’s simple physics.

Responsible people know they are dangerous behind the wheel. They drink at home or take an Uber or cab if they indulge while out and about. However, some think they are exempt from biology and can drink and drive safely. This fatal error takes innocent lives.

Reckless drivers have poor judgment, an unrealistically high assessment of their driving skills, and an unrealistically low assessment of the hazards on the road. As a result, they drive at outrageous speeds, tailgate, weave, and otherwise create danger needlessly. When they inevitably cause a major accident, innocent people suffer.

Florida may be the sunshine state, but torrential downpours happen every hurricane season. When these rains pummel the peninsula, road conditions become dangerous. Making it worse, Floridians are accustomed to sunny weather, and when it finally does rain, it pours. Sick roads, especially in high traffic, are a recipe for disaster.

Some red-light running happens by accident, but many irresponsible drivers simply decide they are exempt from traffic control devices.

Sometimes, drivers miss a red light because they have the sun in their eyes, are distracted, or misjudge speed and distance. On other occasions, certain motorists believe they can speed through a red light unscathed. When they are wrong, the results are devastating.

As with red lights, drivers occasionally miss a stop sign because they have the sun in their eyes, are distracted, or misjudge time and speed. But many stop sign runners just believe they can disregard them without consequence. Stop sign running causes many rollover accidents and side-impact collisions, both of which cause severe injuries.

Teenagers are dangerous on the road for many reasons. Firstly, their inexperience causes them to make tragic mistakes. Secondly, this age group is known for lacking judgment and being prone to make terrible decisions. Finally, teenage drivers tend to believe they are invincible, resulting in engagement in reckless conduct.

Night driving nearly doubles the risk of a car accident. Motorists simply cannot see as far ahead of them. Sometimes, when a hazard becomes visible, it is too late to evade it or stop in time. Also, in Florida, many elderly drivers have limited night vision, making them prone to nighttime accidents.

Vehicles contain hundreds of parts. When a critical one fails during operation, the driver often loses control, resulting in accidents. For example, design flaws in the Ford Explorer resulted in many rollover accidents.

Many drivers change lanes without properly signaling, setting up an accident. Also, some motorists fail to check their blind spot or simply cut it too close.

Wrong Way driving sometimes occurs because of a lapse in judgment. For instance, a tired motorist may misinterpret a sign. Also, many drivers unintentionally turn the wrong way down one-way streets. Worse, drunk and drugged drivers frequently drive the wrong way on highways because of their intoxication.

Stop lights, turn signals, and lane designations keep traffic flowing and prevent accidents. Unfortunately, many drivers disregard the rules of the road and make improper turns, such as turning right at a red light without stopping first.

There are no instances where you can proceed through a red light without stopping, but some motorists think stopping before making a right-hand turn on red is optional.

Aggressive drivers often grow impatient and recklessly tailgate slower vehicles. They even do this when the vehicles they are tailgating are traveling well above the speed limit. Many severe auto accidents occur because a motorist dangerously tailgates another vehicle at high speed.

It’s axiomatic that drugs and driving don’t mix. But some people seem to lose all sense of reality when they take narcotics and believe they can drive just fine. Some even think they drive better on drugs. The accident reports show how wrong they are.

Car accidents in Florida happen for myriad reasons. Drivers can best protect themselves by practicing defensive driving.

Anyone who drives in Florida needs to understand how fault is determined in a car accident. Florida’s system works differently compared to most other states. Its no-fault system creates some confusion, in part because the name leads people to believe the fault is never a consideration.

However, the no-fault rule applies only to accidents where no general damages apply. General damages are those that involve intangible impacts of an injury, such as pain and suffering. As a result, you may receive compensation from your insurer for general damages under the no-fault rule. But on the other hand, you may need to sue in court for general damages.

When general damages apply, comparative negligence comes into play.

Florida’s no-fault car insurance system mandates an injured person’s own insurance policy to provide compensation for economic damages, regardless of who caused the accident. This typically includes medical expenses and lost income, up to the personal injury protection (PIP) limits in the policy. Florida law requires motorists to carry a minimum of $10,000 in PIP coverage.

While Florida’s no-fault law applies to injuries, it does not apply to vehicle damage claims. The at-fault driver (or their insurer) is typically responsible for any damage to another driver’s vehicle.

Also, many people criticize the no-fault system because it covers only 80% of economic damages, excluding property damage. As a result, the injured party is left with the 20% expense. In addition, the legal minimum is $10,000, which is a lot lower than the medical expenses for a serious accident.

Florida’s no-fault car insurance rule does not apply to economic damages, though your right to pursue the other driver for general damages is far from guaranteed. You must have suffered from “serious and permanent” injuries to be eligible. Then, you can “step outside” of the no-fault system and file a lawsuit directly against the at-fault driver.

Examples of qualifying injuries include disfigurement, significant scarring, permanent limitation of a bodily function, or another severe injury.

If you are able to “step outside” of the no-fault system, you must prove the other party’s negligence. There are several ways to build a case:

The official police report is a good starting point. It includes the investigating officer’s opinion about what caused the accident and statements from the drivers and witnesses.

The Florida Department of Highway Safety and Motor Vehicles’ handbook contains the state’s traffic laws. An understanding of these rules helps determine if a legal violation contributed to the accident.

This can include photos or videos from the scene, eyewitness statements, and evidence like skid marks or vehicle damage.

Accident reconstruction may show how the accident occurred and who was at fault.

Lastly, if you “step outside” of the no-fault system, you must contend with comparative negligence. Florida follows a “pure comparative negligence” standard, which means that if you are partially at fault for an accident, your compensation is reduced proportionally. For instance, if you are found 20% at fault, and your general damages total $10,000, you recover $8,000.

Navigating the aftermath of a car accident can be complex, especially when it comes to determining fault and understanding Florida’s no-fault and comparative negligence rules. Before you “step outside” the no-fault system, step inside a personal injury lawyer’s office for a consultation.

Your Florida car accident case fails without proof of the defendant’s negligence. The burden of proving negligence rests upon the plaintiff. The defendant can rebut those allegations once you have presented sufficient evidence to show negligence.

The defense may seek to challenge the evidence. For example, they may dispute the veracity of the plaintiff’s account of the incident. Alternatively, they may stipulate that some evidence is true but argue that it offers no proof of negligence.

When the defense faces irrefutable evidence of negligence, it can still argue comparative negligence. Under Florida’s comparative negligence laws, the amount the defendant must pay is reduced proportionately to the amount of fault attributed to the plaintiff.

Florida’s no-fault car accident system makes proving negligence irrelevant if the damages relate only to medical bills and lost wages, which are covered by the state’s personal injury protection (PIP) insurance requirement. On the other hand, when property damage and general damages are at stake (such as pain and suffering and loss of enjoyment of life), you must prove negligence to recover.

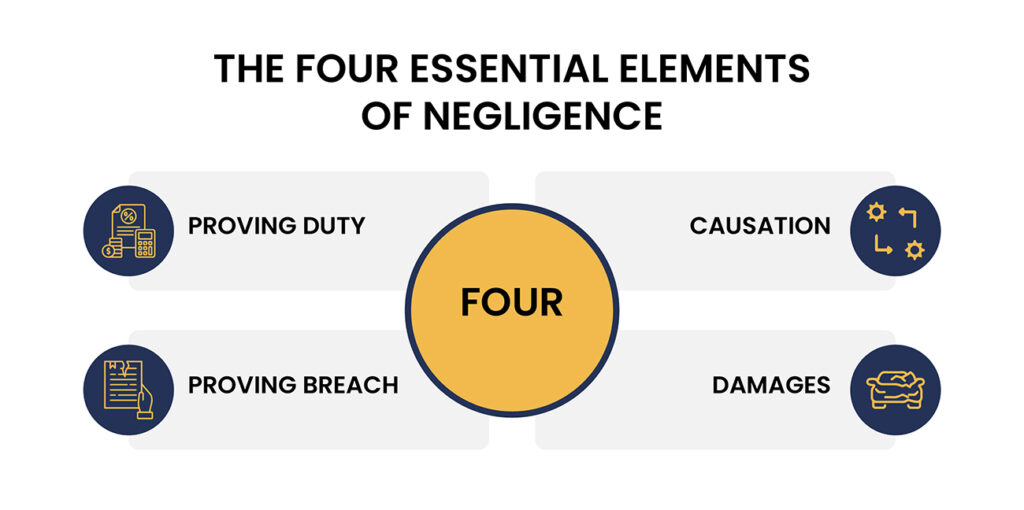

Though Florida’s no-fault car insurance rule makes it different from many states, the four essential elements of negligence remain the same. They include:

Firstly, the plaintiff must prove the defendant had a duty of care. No duty = No Negligence.

The duty element is usually easy to prove in a car accident case because other drivers, as do bicyclists or pedestrians, have a presumed duty of care. Therefore, if any of them cause your car accident, you can easily prove duty.

Duty of care is also presumed for other potential defendants, such as car manufacturers or a municipality responsible for road maintenance. However, these duties have some limitations. For example, manufacturers have limited duty of care when products are used differently than intended.

With the duty of care established, the plaintiff must now prove a breach. Breach means that the defendant neglected the duty of care. A breach is the heart of personal injury claims. It is what the person or entity did wrong.

For instance, speeding, running red lights, or following too closely are common breaches of the duty of care that form the basis for car accident lawsuits.

However, an accident can result in no breach of duty, a so-called no-fault accident. For example, perhaps an act of God, such as a hurricane, caused a car accident rather than another driver’s negligence.

Negligence in itself is insufficient to sustain a car accident lawsuit. The act alleged must have caused harm. No harm, no foul in personal injury law.

Finally, the defense must establish that the damages claimed relate to the act. For instance, plaintiffs often claim emotional distress damages. For instance, PTSD associated with a near-death car accident and feelings of depression from being isolated for months in a hospital and confined to a bed at home may be attributable to the person who caused the accident.

On the other hand, car accident victims have emotional distress from issues unrelated to the accident. The defendant has no liability for these.

Sometimes, the defense looks at comparative negligence as its ace in the hole. Though liable, it may argue that the plaintiff has a partial fault, such as speeding.

Florida’s no-fault car insurance system does not negate the need to prove negligence when damages beyond PIP insurance are at stake. Never assume that PIP coverage is all you can collect. Contact a Florida personal injury lawyer for a consultation.

All car drivers in Florida receive coverage for economic damages under Florida’s personal injury protection (PIP) insurance, including medical costs and lost income. However, only the most grievous of injuries allow for additional damages, such as pain and suffering.

PIP coverage is a type of car insurance coverage that is mandatory in some states, including Florida. It covers the medical expenses of the insured and the insured’s passengers. In some cases, it protects the insured and his family in non-car related accidents.

Also referred to as “no-fault” coverage, PIP insurance pays regardless of fault. Accordingly, after a Florida car accident, each motorist’s PIP coverage pays its insured’s covered expenses, even when the accident is 100% the fault of one driver.

The exact coverage varies depending on the specifics of the insurance policy and Florida laws. For example, in Florida, PIP insurance pays for 80% of medical expenses and 60% of lost wages up to the policy limit. Florida law requires drivers to carry a minimum of $10,000 in PIP coverage.

A common complaint about PIP coverage is that it often leaves injured policyholders with insufficient funds to cover all of the medical and lost income expenses and nothing for general damages, such as pain and suffering. A lawsuit can remedy this gap, but Florida law allows a car accident lawsuit only when injuries are severe, long-lasting, or permanent.

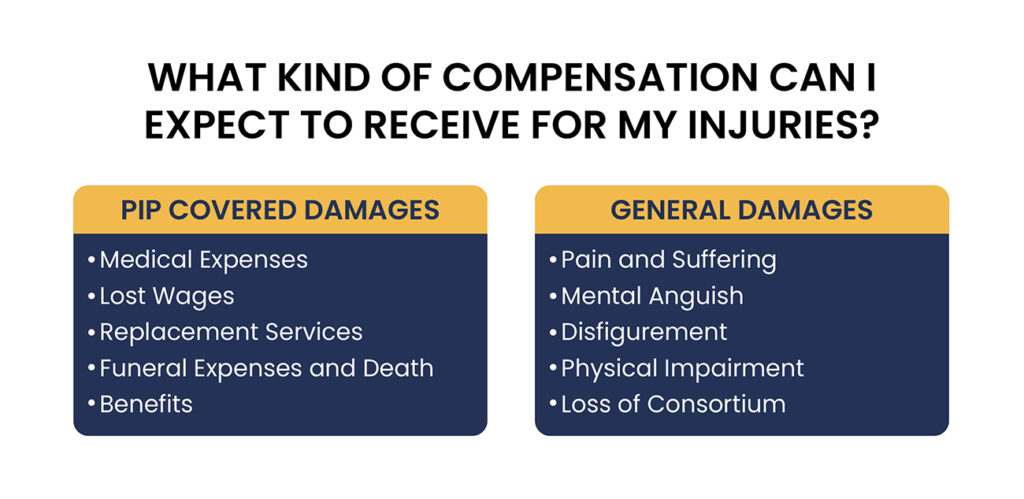

PIP-covered damages include the following:

PIP coverage primarily pays for necessary and reasonable medical expenses, such as hospital bills, medication, surgery, rehabilitation services, and necessary medical equipment.

If the car accident causes you to miss work, PIP may cover a portion of the wages you’ve lost.

If injuries from the accident leave you unable to perform certain tasks of daily living, like house cleaning or childcare, PIP may cover the cost of hiring someone to do these essential activities for you.

PIP coverage pays for funeral expenses and may provide death benefits to the deceased’s family.

In Florida, you can pursue a claim for general damages in a car accident claim if your injuries meet a certain threshold defined by the law. Many car accident injuries are serious yet nonetheless fail to meet this threshold. For a court to accept your claim, one of the following must have resulted from the accident:

It’s important to note that proving that injuries meet this criterion requires medical evidence and expert testimony.

Also, Florida follows a pure comparative negligence rule, which reduces your damages if you have partial fault. An adverse ruling as to your level of responsibility for causing the accident can severely impact your claim.

In the context of Florida personal injury law, general damages refer to the non-economic damages that an injured party can seek compensation for after an accident. These are damages that do not have a specific or quantifiable cost but are nonetheless real losses suffered by the victim.

General damages can include:

It’s important to remember that every case is different, and the potential for recovering these types of damages will depend on the specific circumstances of the case. Most cases end with PIP coverage only. But if your injuries are severe, you may be entitled to more. Contact a Florida personal injury lawyer for more information.

Uninsured and underinsured drivers in Florida are a menace. When they cause accidents, they leave their victims without compensation. Can you imagine being hit by another driver and then receiving nothing except what your personal injury protection (PIP) insurance covers?

That is the situation you may find yourself in if you decline uninsured motorist (UM) and underinsured motorist (UIM) insurance.

While many Floridians grumble about the inadequacies of PIP coverage, one area where it is very helpful is when you are struck by an uninsured or underinsured motorist. Because Florida is a no-fault state, your PIP provider must pay your medical expenses and lost wages.

While that seems like a ray of sunshine if you are hit by one of these drivers, there is still plenty to grumble about, especially if you declined uninsured or underinsured motorist protection.

Firstly, PIP protection covers only 80% of medical expenses and 60% of lost wages, leaving you potentially out of pocket for thousands of dollars.

Then it gets worse. PIP coverage does not cover your property damage, so you can again be out of pocket costs for repairs or a new ride.

Clearly, you need more than just PIP coverage to be fully insured. You also need to cover your vehicle and protect against uninsured and underinsured motorists.

If you lack UIM or UM coverage, you could be seriously out of luck if you sustain a severe injury, such as a traumatic brain injury, paralysis, or disfigurement. Florida law allows you to sue the at-fault driver for damages beyond what PIP pays if your injuries are severe, long-lasting, or permanent.

These damages may include:

But you are unlikely to collect any of these damages from an uninsured or underinsured motorist. People with money tend to carry adequate protection. Therefore, the at-fault driver is likely to be a deadbeat.

But you won’t need to worry about the other driver’s financial status if you have UM or UIM protection.

Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverages are additional types of auto insurance available in Florida. They protect you in situations where the at-fault driver either has no insurance (UM) or lacks adequate insurance to cover your damages (UIM).

Here’s how they work in relation to Florida’s Personal Injury Protection (PIP) coverage:

As a no-fault state, Florida requires all drivers to have PIP coverage. This covers your own medical expenses and lost wages up to the policy limit, regardless of who was at fault.

If the at-fault driver does not have any insurance, your UM coverage steps in to cover some of what your PIP does not. For example, it covers your medical expenses, lost wages, and other damages that exceed your PIP limits.

UIM coverage steps in when the at-fault driver has insurance, but its limits are too low to cover all your damages. It covers the difference between what the at-fault driver’s insurance pays and the total amount of your damages up to the limit of your UIM coverage.

It’s important to note that while UM/UIM coverages are not required by law in Florida, insurance companies are required to offer them to you. This is because those without it expose themselves to serious financial risk. If you decline UM/UIM coverage, you must reject it in writing.

Navigating the aftermath of a car accident can be challenging, especially when dealing with insurance companies. You must understand how to handle the situation to ensure your rights are protected and to secure the compensation you deserve. This guide provides you with some essential tips for dealing with insurance companies after a car accident.

If you’re involved in an accident caused by another motorist, the first step is to notify their insurance company about the incident. We recommend limiting the information you provide at this stage. Stick to the basics: name, the date and time of the accident, the location, and the vehicles involved. Refrain from giving recorded statements or admitting any level of fault.

Documentation is vital. Collect and retain all pertinent information about the accident, such as photographs of the scene, police reports, and witness testimonies. These pieces of evidence can be invaluable in proving the other driver’s liability.

Throughout your communications with the insurance company, be firm. Remember that the insurance adjuster’s job is to minimize the company’s payout. Therefore, they may try to downplay your injuries or damages. It’s important to stand your ground and not settle for less than you deserve.

Seek medical attention immediately, even if you feel fine. Some injuries may not manifest symptoms right away. Also, an immediate medical examination creates a detailed record of any injuries resulting from the accident. Be sure to follow through with all recommended treatment and keep track of your medical records and expenses.

Lastly, consider enlisting the services of a personal injury lawyer. Dealing with insurance companies can be tricky, and a lawyer has the expertise to navigate these complex processes, increasing your chances of getting a fair settlement. For more information on how to handle the aftermath of an accident, visit the National Highway Traffic Safety Administration’s guide on what to do after a car accident here.

If you’re at fault for a car accident, it’s important to remain calm and handle the situation responsibly. Contact your insurance company as soon as possible to report the accident. Provide them with an honest account of the incident, but do not feel compelled to volunteer extraneous information. Just give a basic account of what occurred.

Like in the other scenario, you should gather as much information and evidence as possible from the accident scene. This can help your insurance company understand the circumstances of the accident.

Adhering to your policy’s terms is crucial in these cases. For instance, if your policy stipulates that you must file a police report or inform your insurer within a certain period, make sure you comply.

Cooperate fully with your insurance company during their investigation and claims process. However, avoid admitting fault or making statements to the other party’s insurance company without first consulting your insurer or legal counsel.

Understand your policy’s coverage. Knowing what your insurance covers can help you gauge the potential financial implications of the accident. For instance, if you have liability coverage, it should cover the other party’s damages up to your policy’s limits.

It isl essential to ensure your rights are protected. If the other party’s claims exceed your policy’s limits, you could be personally liable for the excess. In such cases, having legal representation is always beneficial.

Remember, driving safely and maintaining adequate insurance coverage is your best protection against the financial risks associated with car accidents. The U.S. Department of Insurance offers a comprehensive guide on auto insurance, available here, to help you understand your coverage options better.

Car accident injuries range from superficial to life-changing to fatal. In this chapter, we look at the common injuries suffered in car accidents and whether they are eligible for personal injury protection (PIP coverage only or qualify the victim to pursue additional damages in court.

Florida’s PIP insurance covers all injuries suffered in a car accident up to the policy limits. This means that your insurer pays for medical expenses regardless of fault, whether the injury was serious or minor.

However, some severe injuries allow you to “step outside” of Florida’s no-fault system and bring a claim against the driver for general damages. General damages include non-economic impacts of the injury, such as pain and suffering.

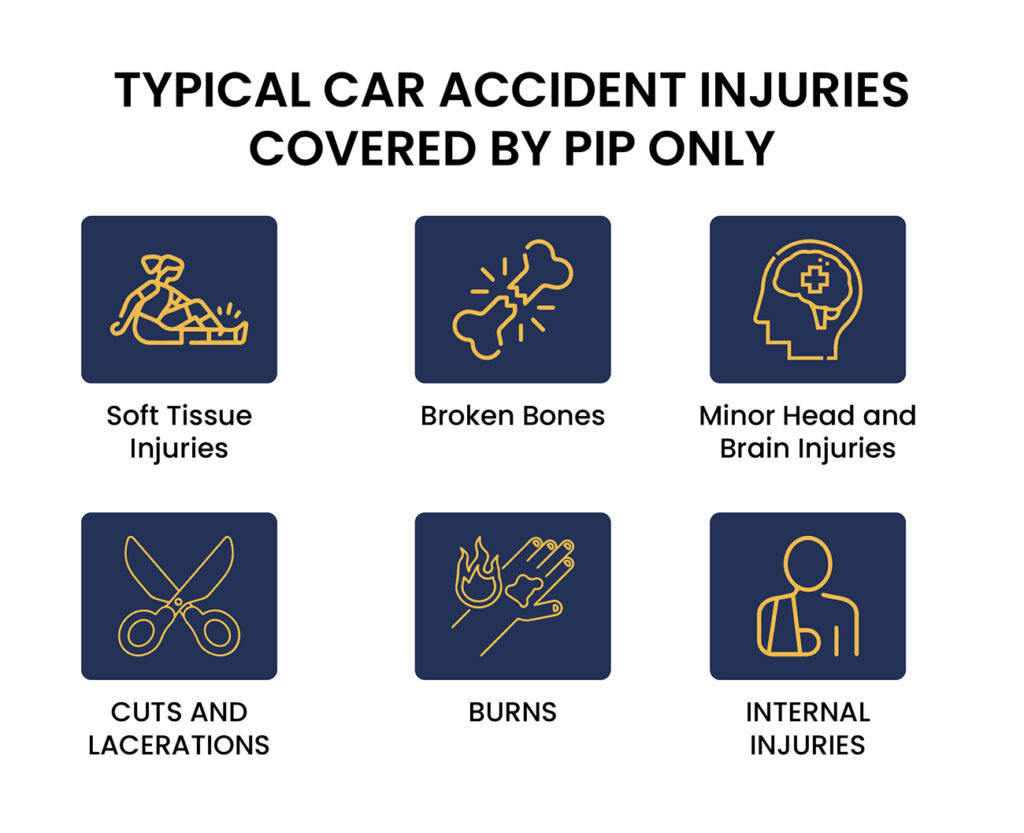

Typical car accident injuries that qualify for PIP coverage only, which means no general damages are available, including the following:

These include sprains, strains, bruises, and other injuries to muscles, tendons, or ligaments. For instance, whiplash, a common type of soft tissue injury often sustained in rear-end collisions, is atypically covered by PIP only.

Though broken bones can result in severe injuries, they are mostly temporary and, therefore, a PIP-only injury.

Head and brain injuries are wobblers between PIP-only and eligible for general damages. For instance, a cut on the head or a few headaches after an accident are too temporary in nature to qualify for general damages.

These injuries can range from minor scrapes to severe cuts that require stitches or even surgery. When they are only temporary, they are PIP-eligible only.

If a car accident results in a fire or explosion, PIP insurance would typically cover burn injuries. Only very severe burns, such as those resulting in lasting damage, are eligible for general damages.

Some internal injuries are minor and resolve on their own, making them ineligible for general damages.

Note that Florida’s PIP coverage covers 80% of all necessary and reasonable medical expenses up to the policy limit (minimum of $10,000), 60% of lost wages, and a $5,000 death benefit.

You may be noticing that some car accident victims are victimized again by the yawning gap between what PIP covers and the out-of-pocket costs. Even a minor car accident injury can leave a person eligible for PIP only with thousands of dollars in medical bills, even if they are 0% responsible for the accident.

Florida’s car insurance law determines eligibility to seek general damages more by the severity of the injury than the type. As a result, some minor injuries are automatically ineligible. Some injuries can go either way, depending on severity, while other are presumed eligible, such as ones causing paralysis or death.

To qualify for general damages, the injuries must contain one of the following elements:

For example, a head injury resulting in permanent brain damage is eligible for general damages under Florida law. The individual will suffer for life with a deteriorated mental capacity. On the other hand, a head injury resulting in a minor laceration would not qualify. But, by the same token, if the laceration caused permanent scaring, it may qualify.

Never assume that your injury is only eligible for PIP coverage. Florida law contains many precedents for injuries that are eligible for general damages. If you feel your injury may entitle you to more than PIP coverage, contact a personal injury lawyer.

Personal injury lawyers help their clients win car accident cases by building strong cases, negotiating to win, and using their skills of persuasion.

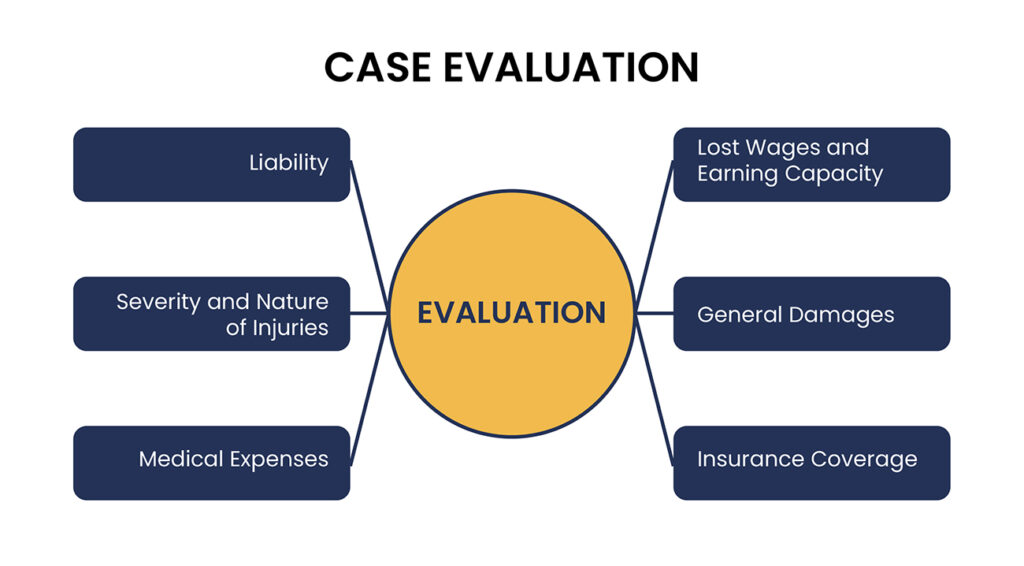

At the start of the process, a personal injury lawyer must accurately evaluate the case.

Personal injury lawyers evaluate car accident claims through a comprehensive process that looks at various factors related to the accident, the resulting injuries, and the potential for financial recovery. Some of this evaluation occurs at the initial consultation. Other aspects require additional investigation, including engaging in the discovery process after filing a lawsuit.

To evaluate your case thoroughly, personal injury lawyers need to consider and investigate the following factors:

Most importantly, a personal injury lawyer must analyze liability. No liable party means no lawsuit. For a car accident, the lawyer may review the accident report, witness statements, photos or videos from the scene, and any other indicators of liability.

In addition, the lawyer determines if more than one party has liability. For instance, another driver may be liable for the accident, and a vehicle manufacturer who sold a defective product.

The type and severity of the injuries are critical factors in evaluating a car accident claim, especially in Florida.

Because Florida is a no-fault car insurance state, each party’s insurer pays its client’s economic damages regardless of fault. The injuries must be grievous for the victim to “step outside” the no-fault system and sue for additional damages. Lawyers review medical records in detail to make this determination.

In addition to the severity and nature of the injuries, the lawyer must evaluate all past, current, and projected future medical expenses related to the accident. For instance, these could include the following:

If the injury caused the victim to miss work or reduced their ability to earn a living in the future, these lost wages and lost earning capacity can be factored into the claim. Usually, PIP coverage pays 60% of lost wages and earning capacity.

General damages refer to the intangible impacts of the accident, such as pain and suffering. The injury must be permanent or severe to qualify for general damages in Florida.

General damages include the following:

The limits of applicable insurance policies affect how much compensation is realistically available. Both the injured party and at-fault party’s insurance come into play.

Most personal injury cases end in a settlement. Because of this, negotiation skills are paramount. Lawyers employ strategies and tactics to impel the other side to settle, such as opening with a high demand, providing a strong, evidence-based justification for it, and demonstrating a willingness to continue litigating all the way to trial.

Many attributes make an effective negotiator. The following are chief among them:

Though most personal injury lawyers end with a settlement, a few cases go to trial. To win, a personal injury lawyer needs compelling evidence to convince a jury the defendant is liable by a preponderance of the evidence. In preparing a case, a personal injury trial lawyer assembles this evidence, including police reports, medical records, expert testimony, witness accounts, and other proofs.

He then skillfully argues that the evidence shows the defendant has a duty of care and harmed the plaintiff by breaching that duty of care. In addition, he establishes the plaintiff’s damages through evidence, such as medical records.

Personal injury lawyers serve a vital function for their clients. They build the case needed to win, negotiate for full compensation, and use their skills of persuasion to get their clients every penny of compensation they deserve.

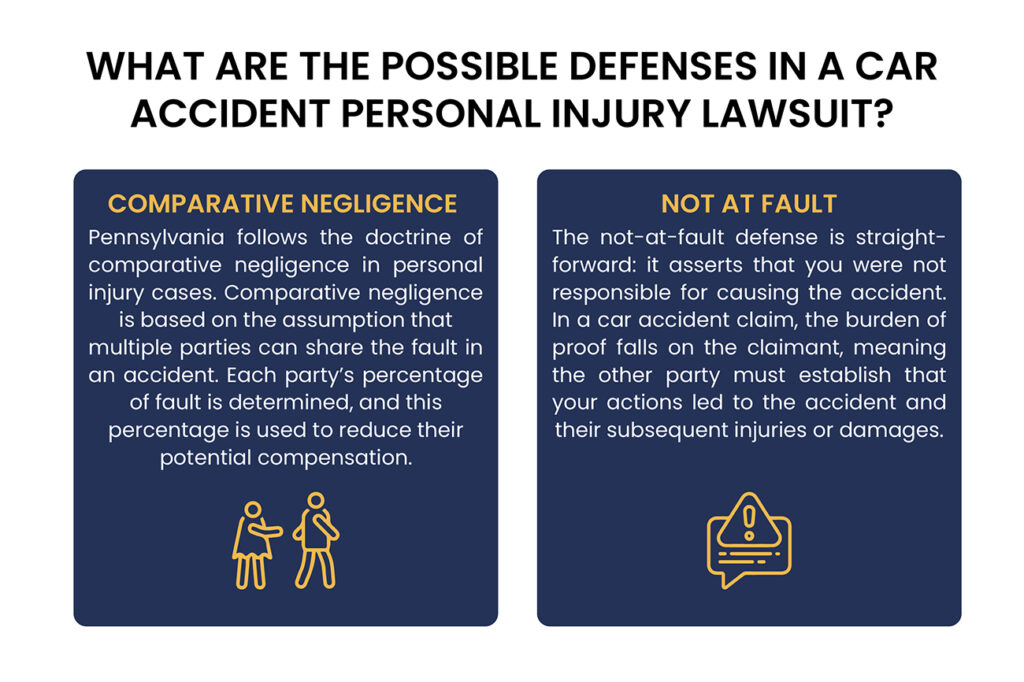

When you’re involved in a car accident, you may face a claim from the other party. Therefore, it is essential to understand the defenses that may be available to you, as they can drastically affect the outcome of the claim. In this article, we explore the comparative negligence and not-at-fault defenses in the context of Pennsylvania’s personal injury law.

Pennsylvania follows the doctrine of comparative negligence in personal injury cases. Comparative negligence is based on the assumption that multiple parties can share the fault in an accident. Each party’s percentage of fault is determined, and this percentage is used to reduce their potential compensation.

For example, if you’re found to be 20% at fault in a car accident and the total damages amount to $100,000, you would be eligible to receive $80,000 (or the total damages minus your percentage of fault). It’s crucial to note that Pennsylvania applies a modified comparative negligence rule. Under this rule, if you have more than 50% of the fault, you are barred from recovering any damages.

The comparative negligence defense is vital because it allows partially at-fault parties to recover damages. However, it requires clear evidence demonstrating each party’s degree of fault, making it crucial to collect as much information and evidence as possible from the accident scene. Pennsylvania’s comparative negligence law can be more comprehensively explored here.

The not-at-fault defense is straightforward: it asserts that you were not responsible for causing the accident. In a car accident claim, the burden of proof falls on the claimant, meaning the other party must establish that your actions led to the accident and their subsequent injuries or damages.

You may use evidence like traffic surveillance footage, photographs of the accident scene, witness testimonies, and police reports to support your defense. In some cases, you may need accident reconstruction experts to establish the chain of events leading to the accident.

Refrain from admissions of fault at the scene or to insurance adjusters without first consulting your attorney. Initial impressions of an accident scene can be misleading, and any admissions of guilt could be used against you in later proceedings. For more about how to handle such situations, click here.

It’s essential to understand the legal defenses available to you if you’re involved in a car accident. Navigating these defenses can be complex, but understanding the concepts of comparative negligence and not-at-fault defenses can significantly improve your chances of a successful defense. It is always beneficial to seek legal counsel after an injury accident, as lawyers provide guidance tailored to your case. Ultimately, the best defense against car accident claims is always safe and responsible driving.

Your consultation with an attorney member of Rosen Injury Law is FREE! You can connect to a representative by calling 954-451-0532 or filling out the contact form below.

100% Privacy Guaranteed

Table of Contents

Table of Contents